Temporary value drainers like cartel-breaking

rumors and electricity prices increases have created significant opportunity

in the cement sector which continues to be the most lucrative in Pakistan.

High cement prices, supported by

the evil of cartelization, persevering demand (September dispatches were highest

in the country’s history) and low coal prices (Coal is the largest cost driver

for the industry) are all a few factors that continue to support stellar

margins and exceedingly high profits.

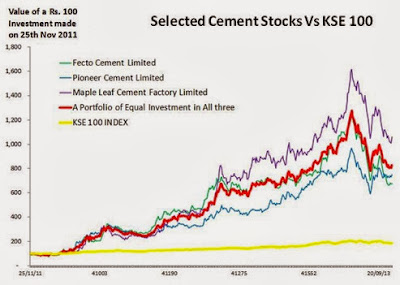

Now doubt, the Cement sector has

been one of the best performing in the last two years as given by the following

graph.

-

Swamped with cash, companies like

Lucky Cement have gone for acquisitions, while others like Pioneer cement have swathes

of cash on their balance sheet and no idea what to do with it.

Scares like cartel break-up have

hurt investor returns in the last one month, but this only presents the shrewd

investor with opportunity. Given investigations and revelations by KASB and

other brokerage houses, the scare is unwarranted, and the camaraderie is here

to stay. Cement prices are likely going to stay high in the intermediate term

and continue to support the margins of these cash cows. In fact just recently

there was news of price increases in the Northern region where players have

already increased prices by around Rs. 20 per bag.

Given the evil of cartelization,

it is thus with a confused and heavy heart that I must present the sector as a

viable investment opportunity. While my heart tells me that I should be writing

against this evil, let us just put being a Samaritan on the back burner for a

while and concentrate on making money.

Owing to recent the cartel scare,

along with the electricity price scare, both of which are explained later on cement

stocks have been beaten to the point of whimpering. The following chart

explains this rather beautifully (as made by me):

Big Scare 1.0

Cartelization is perhaps the most

pertinent theme of the industry, perhaps seconded only by low coal prices which

is like the sonay pe suhaga. You see

the cement industry has vast overcapacity. Days of good development in the

early part of 2010s resulted (we all remember financing our cars at 4% don’t we)

resulted in increased demand of cement and the industry invested heavily in

capacity expansion. However, later on Zardari came and destroyed everything end

of story. So now there is significant capacity and not enough demand. Under

normal (and fair) economics, the cement companies decrease prices and go into

competition, in order to sell more and drive up capacity utilization. But

obviously doing so can be disastrous for many as low prices eat into margins.

In fact cartelization was pretty much the

case when CCP busted APCMA’s office sometime back ( In don’t know the exact

time) and loads of companies such as Pioneer Cement, Gharibwal Cement, Bestway

Cement and the world famous Maple Leaf

Cement restructured their debt obligations (effectively defaulted).

Later on, the companies got

braver and the country got Zardarier, and ‘The Cartel’ (sounds like the Mafia

or something) has been getting its way ever since. Perhaps we need ‘the Untouchables’

to save us. Even Ajay Devgan would do.

However, the scare was not as

deadly as it sounds, the apparent damage was caused by a smaller player wanting

to drop prices while the a bigger player threatened to walk away which was all

amicably resolved later on. No action by the CCP or anything. Just an internal

matter. However, the market was not as brave, and the cement index lost significant

capitalization as a result. Later on news of a patch up duly appeared the

stocks had their heyday again. However, their woes did not end there and then

came big scare 2.0.

Big Scare 2.0

Just as stock prices came up at

the surface gasping for air, the government dropped another bomb on them by

announcing an increase in electricity tariffs by around 60%. The scare hasn’t been

felt by the masses as it used to before the present government (political gimmickry?)

but cement stocks took hit hard and hence the Big Scare 2.0 as illustrated in above graph.

An increase in electricity prices

is especially harmful for those companies, that obviously, buy their electricity

form the natural grid rather than produce it in-house. Companies like Fecto

Cement take the brunt of such changes.

The price increase would indeed

have spelled bad for the industry or specific companies, but the companies have

taken a measure to circumvent this by increasing Cement prices by around Rs. 20

per bag - something that they have been doing since the last five years. Here I

present a graph that details the quarterly retention prices (prices net of

sales tax and other ancillary items) for a few companies during the last eight

quarters:

The above chart only presents

scanty prices. This is because I am only in the process of building financial

models for all these companies. Nevertheless, prices for Pioneer Cement have

been plotted back to almost 20 quarters. The graph aptly depicts cement price increase

since last 5 years. But stretching back of Pioneer Cement Prices back to

September 08 reveals a whole new page of history.

The Big Dip, as highlighted, was

a time when CCP took action against alleged cartelization, raided APCMA offices

and what not and what ensued was a dip in cement prices. Together with this, many

cement companies defaulted since they could not sustain the debt they recently

taken up for expansion. Maple leaf, the 16-bagger, is one of them.

Given the fact that the cement

companies are getting out hands, would this happen again?

Well, we can only speculate at

best. However we do know that the Big Scare 1.0 occurred because of an internal

matter and not because of any regulatory action. Secondly, we also know that

cartelization is most necessary in face of low capacity utilization. Given

September quarter dispatches being the highest in history, I don’t think anyone

would want to threaten prices for the sake of increasing utilization. So I

believe the high prices are here to stay.

So what about the recent raise in

electricity tariffs?

The tariffs will surely have an

impact on margins for companies that produce their own electricity, like Fecto

Cement. But that is a problem no more, as cement prices have recently been

raised by Rs. 15-20 per kg, amounting to around Rs. 300-400 per ton. I have not

run any calculations but something tells me they should be enough to cover any

margin loss due to the power price hike.

On a side note, companies like DG

Khan Cement (despite my detestation for large caps), and others, that produce

their own electricity should benefit most from the price hike since for them there

has been no price hike. They actually produce their own electricity from gas

whose prices really haven’t risen much. Since cement prices move together,

these companies will benefit most from the price increase.

Good times are here to stay for

the Cement Industry. Inflated prices will keep margins inflated and ensuing

earnings which will in fact continue to positively impact valuations. Given the

beating the industry has taken over the past few weeks - the prices are at very

attractive levels. And given the cement price increase as of late, stock prices

are only going to go up and it is only a matter of time when the pre-cartel-breaking-rumors

levels are going to be achieved. Perhaps the market already realizes all these

factors and for this reason, many stocks in the sector closed at ‘upper-locks’

on the last trading day. Perhaps we are at the advent of another bull run. I

see 25-30% returns from current levels in the next few weeks especially in the

wake of the upcoming results reason and suggest taking positions as soon as

possible for healthy returns, especially in the short term.

The market opens in

about 1.5 hours. It is time to jump on the band wagon!